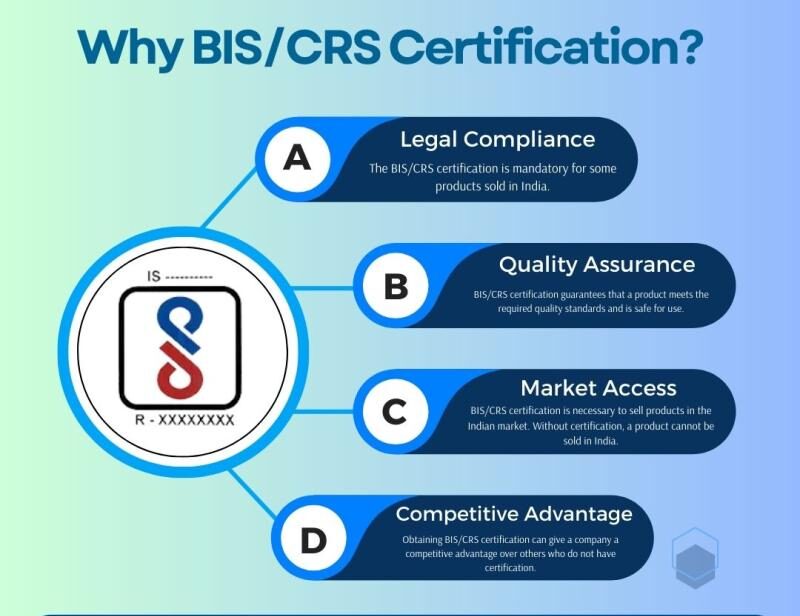

BIS registration in India is crucial for ensuring that products meet the quality and safety standards established by the Bureau of Indian Standards. It serves as validation of adherence to specified norms, thereby enhancing consumer trust and market competitiveness. The BIS mark signifies compliance, boosting the credibility of products and facilitating trade both domestically and internationally.

For manufacturers and businesses, obtaining BIS registration demonstrates a commitment to excellence and quality assurance, which can help build a positive brand image and differentiate products from competitors.

BIS registration offers a multitude of advantages for businesses in India, providing access to government schemes, financial support, subsidies, and incentives aimed at fostering growth and development. It enhances business credibility, streamlines access to credit, and creates opportunities in government and private sector procurement.

Our Utkrasht BIS Registration Services:

At Utkrasht, we simplify the BIS registration process, ensuring compliance with all eligibility criteria and requirements. Our comprehensive services include:

Consultation and Eligibility Assessment:

Our experienced consultants offer expert guidance on BIS registration, assessing your business’s eligibility and assisting in meeting the necessary criteria.

Document Preparation:

We assist in preparing the required documents, such as proof of business registration, product specifications, and other essential paperwork necessary for BIS registration.

Application Filing and Follow-up:

Our dedicated team manages the filing of the BIS registration application with the Bureau of Indian Standards and ensures regular follow-up for a seamless process.

Post-Registration Support:

We provide guidance on leveraging the benefits associated with BIS registration, including compliance with quality standards, market credibility, and enhanced competitiveness.

Position your business for success with Utkrasht’s reliable and efficient BIS Registration services. Contact us today to learn more about how we can assist you in obtaining BIS registration and unlocking the benefits available to your business.

Contact Information:

For more details or to initiate BIS Registration, please visit our website or contact our dedicated team via email or phone. We’re here to address your queries and guide you through the BIS registration process, ensuring a smooth and compliant experience.

Incorporating a startup in India usually involves several key steps. These steps typically include registering the business name, acquiring a Director Identification Number (DIN) and Digital Signature Certificate (DSC), preparing the Memorandum of Association (MoA) and Articles of Association (AoA), and submitting the incorporation documents to the Registrar of Companies (RoC).

Registering as an MSME brings forth a host of advantages, including access to government schemes and subsidies, priority sector lending, protection against delayed payments, eligibility for tax benefits, and expanded market opportunities.

A private limited company stands as an independent legal entity, affording its owners limited liability protection and accommodating multiple shareholders. On the other hand, a sole proprietorship represents an unincorporated business solely owned and managed by an individual, offering simplicity but lacking limited liability protection.

Indeed, obtaining a PAN (Permanent Account Number) is mandatory for incorporating a startup in India. PAN serves various tax and regulatory purposes, including opening a bank account, filing tax returns, and conducting financial transactions.

Absolutely, foreign nationals and Non-Resident Indians (NRIs) are permitted to incorporate a startup in India. However, specific conditions and regulatory prerequisites, such as obtaining requisite approvals, may be applicable depending on the nature of the business and the residency status of the foreign national.

Empowering Businesses for Unparalleled Success through Innovative Strategies, Dedication to Excellence, and Customized Solutions Tailored to Your Needs.

Note: Payments for services are only accepted in the name of Utkrasht Udhyog Seva Private Limited and the type of account is solely “Current Account” via NEFT/IMPS, RTGS , Razorpay and we do not accept payments on personal accounts or under any other name.

Chat with us